|

If you're considering buying a home using FHA financing, you may have concerns about FHA repairs. The most common concerns often surround Paint Surfaces, Evidence of Termite Damage, Plumbing, Heating and Electrical Systems, Roofing and Appliances. Below (in red) are excerpts from the FHA handbook regarding these common concerns. I hope you find these helpful, and if you have specific questions, please feel free to call, or email me back!

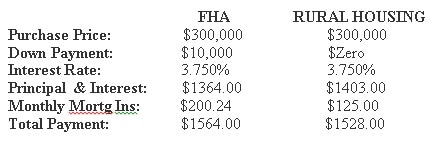

Handbook 4000.1 505 Effective Date: 09/14/2015 | Last Revised: 12/30/2016 Cosmetic or minor repairs are not required, but the Appraiser must report and consider them in the overall condition when rating and valuing the Property. Cosmetic repairs include missing handrails that do not pose a threat to safety, holes in window screens, cracked window glass, defective interior paint surfaces in housing constructed after 1978, minor plumbing leaks that do not cause damage (such as a dripping faucet), and other inoperable or damaged components that in the Appraiser’s professional judgment do not pose a health and safety issue to the occupants of the house Defective Paint If the dwelling or related improvements were built after 1978, the Appraiser must report all defective paint surfaces on the exterior and require repair of any defective paint that exposes the subsurface to the elements. If the dwelling or related improvements were built on or before December 31, 1978, refer to the section on Lead-Based Paint. Lead-Based Paint Improvements Built on or Before 1978 The Appraiser must note the condition and location of all defective paint and require repair in compliance with 24 CFR § 200.810(c) and any applicable EPA requirements. The Appraiser must observe all interior and exterior surfaces, including common areas, stairs, deck, porch, railings, windows and doors, for defective paint (cracking, scaling, chipping, peeling, or loose). Exterior surfaces include those surfaces on fences, detached garages, storage sheds, and other outbuildings and appurtenant Structures. Termite Inspections will not be required as long as there is no evidence of termite infestation or damage. Below is the excerpt addressing when an appraiser would require a termite report. Wood Destroying Insects/Organisms/Termites The Appraiser must observe the foundation and perimeter of the buildings for evidence of wood destroying pests. The Appraiser’s observation is not required to be at the same level as a qualified pest control specialist. If there is evidence or notification of infestation, including a prior treatment, the Appraiser must mark the evidence of infestation box in the “Improvements” section of the appraisal and make the appraisal subject to inspection by a qualified pest control specialist. The Appraiser must observe the physical condition of the plumbing, heating and electrical systems. The Appraiser must operate the applicable systems and observe their performance. If the systems appear to be damaged or do not appear to function properly, the Appraiser must condition the appraisal for repair or further inspection. Electrical System The Appraiser must notify the Mortgagee if the electrical system is not adequate to support the typical functions performed in the dwelling without disruption, including appliances adequate for the type and size of the dwelling. The Appraiser must examine the electrical system to ensure that there is no visible frayed wiring or exposed wires in the dwelling, including garage and basement areas, and report if the amperage and panel size appears inadequate for the Property. The Appraiser must operate a sample of switches, lighting fixtures, and receptacles inside the house and garage, and on the exterior walls, and report any deficiencies. The Appraiser is not required to insert any tool, probe or testing device inside the electrical panel or to dismantle any electrical device or control. Plumbing System The Appraiser must notify the Mortgagee if the plumbing system does not function to supply water pressure, flow and waste removal. The Appraiser must flush the toilets and operate a sample of faucets to observe water pressure and flow, to determine that the plumbing system is intact, that it does not emit foul odors, that faucets function appropriately, that both cold and hot water run, and that there are no readily observable evidence of leaks or structural damage under fixtures. The Appraiser must examine the water heater to ensure that it has a temperature and pressure-relief valve with piping to safely divert escaping steam or hot water. If the Property has a septic system, the Appraiser must examine it for any signs of failure or surface evidence of malfunction. If there are readily observable deficiencies, the Appraiser must require repair or further inspection. Roof Covering The Appraiser must notify the Mortgagee if the roof covering does not prevent entrance of moisture or provide reasonable future utility, durability and economy of maintenance and does not have a remaining physical life of at least two years. The Appraiser must observe the roof to determine whether there are deficiencies that present a health and safety hazard or do not allow for reasonable future utility. The Appraiser must identify the roofing material type and the condition observed in the “Improvements” section of the report. The Appraiser must report if the roof has less than two years of remaining life, and make the appraisal subject to inspection by a professional roofer. When the Appraiser is unable to view the roof, the Appraiser must explain why the roof is unobservable and report the results of the assessment of the underside of the roof, the attic, and the ceilings. Appliances Appliances refer to refrigerators, ranges/ovens, dishwashers, disposals, microwaves, and washers/dryers. Appliances that are to remain and that contribute to the market value opinion must be operational. Must a new or existing home have a stove in order to be eligible for FHA financing? Neither a new home nor an existing home has to have a stove in order to be eligible for FHA financing.  Did you know that there is a 100% mortgage product with Low Rates, discounted mortgage insurance, and you could even possibly finance your closing costs? The Rural Housing Guarantee Mortgage combines some of the most attractive terms for a mortgage with 100% financing, and you could get into your new home with little to no money out of pocket. Below is a comparison to the popular FHA mortgage, which offers a 3.5% down payment: The Rural Housing Mortgage is available in certain rurally designated areas including Southern Anne Arundel County, Calvert County, areas of Prince George’s County, Western Maryland and the Eastern Shore. Please call me for details and a no obligation pre-approval at 410-984-8692.

On average interest rates have risen by 0.50% since Election Day from an average of 3.5% to an average of 4.0%. This trend is expected to continue. If you have been on the fence about buying, you may want to consider jumping off! Below is an illustration of the impact on a principle and interest payment for a $300,000 mortgage:

Mortgage Insurance: Insurance which protects the lender against default on a mortgage. Premiums are paid by the borrower. Generally speaking mortgage insurance is charged to borrowers, who put down anything less than 20% on a purchase. Similarly, for refinances, if the amount financed is greater than 80% of the appraised value, some form of mortgage insurance applies. Traditionally mortgage insurance has been paid monthly by borrowers and included in their mortgage payments until the loan is paid down sufficiently to allow it to be removed. Historically this had been a one size fits all premium. However, in recent years there has been competition among insurers for certain types of loans, and this allows us to “shop” mortgage insurance premiums among companies. Not all lenders have the ability to do this, so it may be a good idea to ask your loan officer what the mortgage insurance options are. In addition to being able to shop for the lowest rate, there are other alternatives as well, such as lender paid mortgage insurance. This is insurance which is paid by the lender all at once up front, and is financed through the borrower paying a slightly higher interest rate. In most cases this leads to a significantly lower monthly payment. A good loan officer can walk you through the options you have regarding mortgage insurance. If you have questions, please feel free to call me! Holly Hart – Loan Officer, NMLS ID 219868 For more info contact 410-984-8692 or [email protected]  Foreclosures are properties which have been taken back by a bank or an insurer after an owner stops making payments. They can be a great way to get a “good deal” in many cases, but there are certain nuances to this type of transaction that you should be on the lookout for. Most of these properties are sold “as is”. What that means is that the bank who owns the property is not willing to make any repairs to the property as a condition of the sale – period. Keep in mind that many of these properties could have been in disrepair at the time of foreclosure, and have been sitting vacant for many months. If you are obtaining financing for your purchase, the new lender will have the property appraised, and could and likely will require certain things to be repaired PRIOR to settlement.* Even if you, as the buyer, are willing to make the repairs yourself, you cannot make repairs to a property you do not own yet. This means you would be required to change your loan to a “Renovation loan”, or walk away from the transaction. Renovation loans can be a great way to purchase a distressed property, but the terms and costs can be different than with standard conventional or FHA loan. Often you will not know the cost or extent of the repairs needed until a full complete inspection is done by a certified inspector. *Below is a list of items that could be flagged. This lists is not all inclusive, but are good examples:

Additionally, some banks or insurers are exempt from transfer taxes. Entities which are exempt include Fannie Mae, Freddie Mac, and VA. If the property is owned by one of these entities, this means all the transfer taxes get charged to the Buyer. This could be the difference of thousands of dollars in additional closing costs. You will want to make sure you are aware of this up front, and have accounted for the additional money that will be needed at settlement. Holly Hart – Loan Officer, NMLS ID 219868 For more info contact 410-984-8692 or [email protected] This is not a guarantee to extend consumer credit as defined by Section 1026.2 of Regulation Z. Programs, interest rates, terms and fees are subject to change without notice. All loans are subject to credit approval and property appraisal. First Home Mortgage Corporation NMLS ID #71603 (www.nmlsconsumeraccess.org). Holly Hart NMLS ID 219868 |

AuthorAs a mortgage lender, Holly has been helping her customers purchase and refinance their homes for over 20 years! Whether you are a first-time homebuyer, a “move up” buyer, or even downsizing, she provides valuable information and expertise to aide you along your home buying journey. Archives

January 2018

Categories |

RSS Feed

RSS Feed